YFI IN INR HOW TO

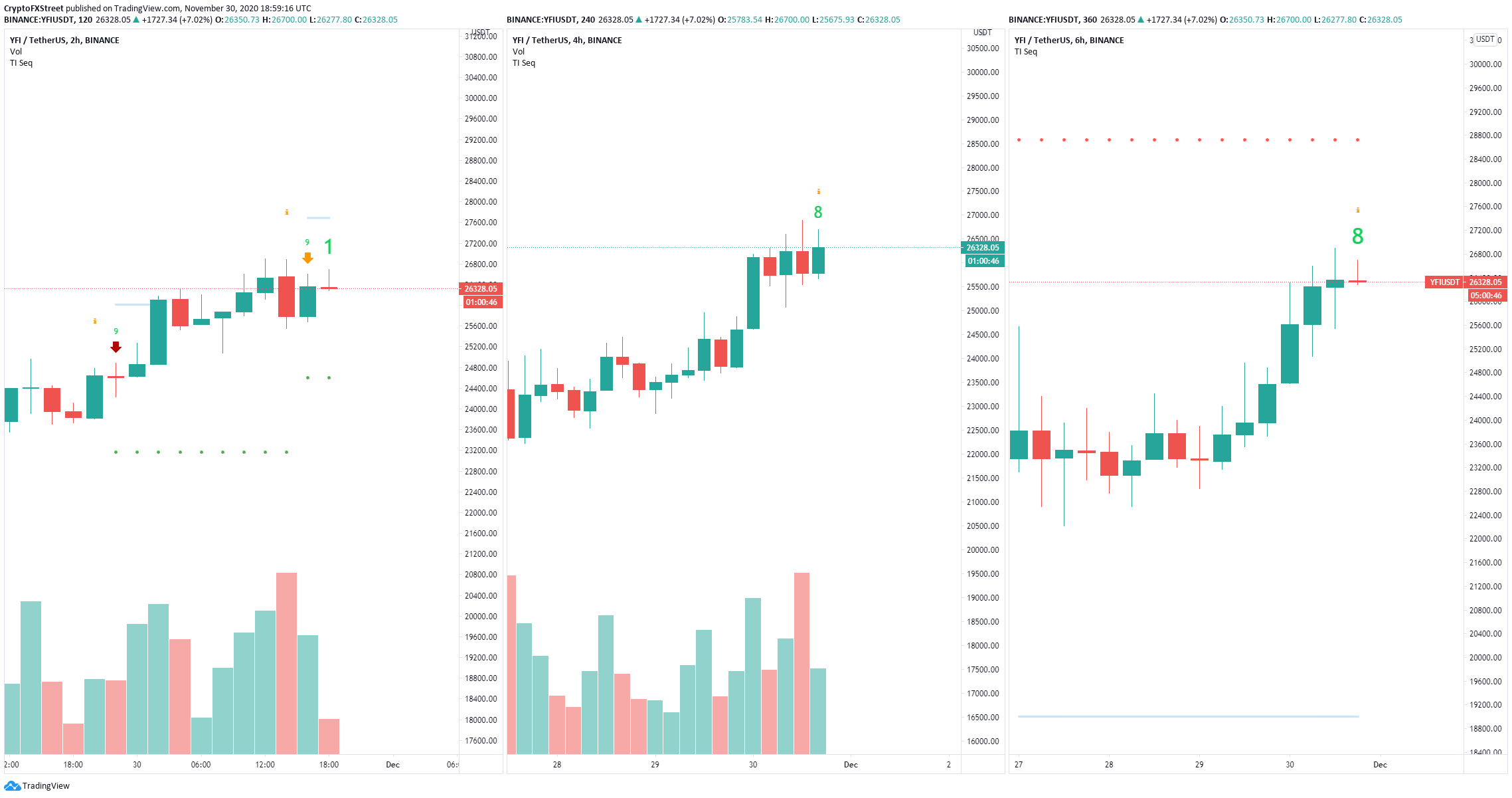

How to do Yield Farming in YFIIĬurrently, YFII has one of the highest ROI that can go up to 2000 percent in some pools. Balancer enables a swap between YFII and DAI while Binance facilitates the trading of YFII for BTC, Binance Coin (BNB), Binance stable coin (BUSD), and USDT. Trading the projects token can be done on Balancer and Binance. Just with DeFi protocols such as SushiSwap, YFIIs smart contract is unaudited. However, this is a temporary governance model as the project implements governance through a decentralized autonomous organization (DAO). Seven of the 11 signatories have to agree to reach consensus. Governance issues on the network are delegated to 11 signatories that engage using a multi-signature model. But, as it is, the community may be after profits from yield farming. This makes it hard for the systems token economics to be upgraded.Įxperts warn that the platforms community has to look for ways to make it decentralized to attract a vibrant ecosystem. For instance, the network blocked all methods for updating or modification. Unfortunately, the road ahead looks bumpy for YFII. Liquidity providers on YFII are newcomers in the DeFi world. We are pissed at Balancers hostile blacklist, the sign reads. The projects pink-colored poster portrays its inclination to the young generation thats nationalistic. This indicates the diplomatic standoffs between China and the United States since discussions on the social media platform effectively blocks English-speaking persons from the US. The protocol has a strong community that gathers on WeChat. However, a few days later, the network attracted cryptocurrency exchanges, virtual currency hedge funds, mining pools, and centralized finance projects. Surprisingly, the clone started on a high note in its new market compared to its parent performance in the west.Įlaborately, after being launched towards the end of June 2020, a few Chinese liquidity miners joined the new force. The contrast is that YFI was developed in the west, while YFII is the eastern region. The protocol is currently popular in the Chinese DeFi market. YFII is a DeFi protocol that facilitates yield aggregation and uses a token halving model to ensure equitable distribution of tokens. The YFI clone holds that its halving model mirrors that of Bitcoin (BTC) so that the tokens will be fairly distributed to the community. YFII is led by an anonymous team that goes by the pseudonym White Noise, providing updates on Medium. In the first week, 30,000 tokens were removed from total circulation. YFII was born through a hard fork and implemented the YIP-8 proposal. Unfortunately, the needed 33 percent quorum was not achieved. When votes were cast, 80 percent were for the proposal, while 19 percent were against. In the proposal, the system would initiate a weekly halving of issued YFI tokens to provide for a steady change in liquidity. To prevent inflation, a YIP (yEarn Improvement Proposal)-8 was issued.

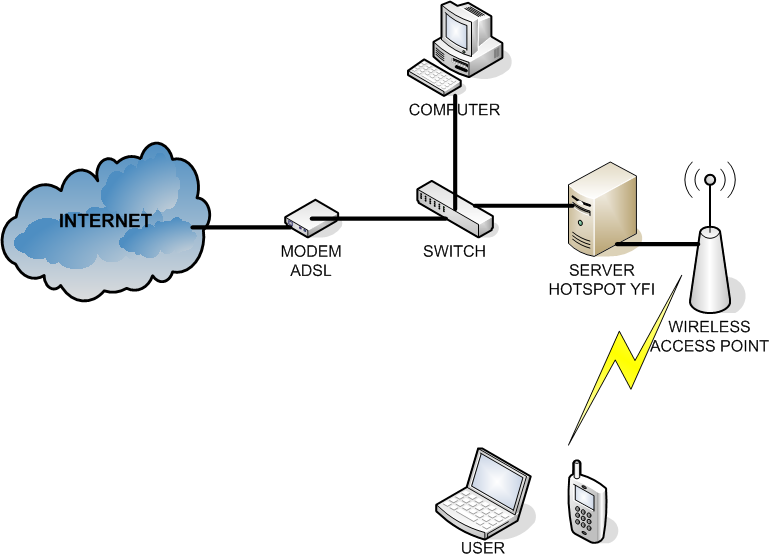

However, governance on Yearn is enabled using the YFI token.īut, as the token was issued to yield farmers for pools liquidity provision, it presented a looming drop in pool liquidity because of a weekly supply increase of 30,000 YFI. The platform uses yToken to facilitate the withdrawal of earnings and deposits.

Instead, it aggregates deposits and delivers them to a network that would give depositors the highest interest.

Yearn is not necessary a DeFi protocol like Compound or Aave. To have a clear background of how and why YFII was born, lets start from the top Yearn.

0 kommentar(er)

0 kommentar(er)